Preparing to end your marriage can be emotional, traumatic and even dramatic – all of which can make it very difficult to proceed calmly and rationally as you figure out all the practical things you will need to do. Ensuring that you select the right process for you can make a big difference in whether things move along as quickly and smoothly as possible.

What does this journey look like and the steps you can take? We’ve created a simple “journey” graphic that puts in order some of the things you can act on before the formal process begins.

Making the Decision

While the journey technically starts after you decide to divorce, it’s advisable to exhaust every resource available in order to be certain you are making the correct decision for you and your family. Before you commit to the expense, the time and the radical transformation a divorce will bring, it’s a good idea to commit to working through whether this really is the only option.

Invest in marriage counseling, with both partners present. If your spouse will not participate, don’t assume that option is off the table – there are counselors that specialize in marriage who will work with only one partner. Working with a professional can provide you with support and help you to frame issues and determine if there are changes you can make that will improve things.

Similarly, engaging with a trained professional in therapy that offers you support and helps you focus on yourself – outside of your marriage issues – can be tremendously helpful. There are many options, from long-term psychotherapy, a short goal-focused course of several weekly sessions, or very convenient internet-based e-therapy.

If you’ve exhausted all the above options, there are few steps to take to ensure the process goes smoothly.

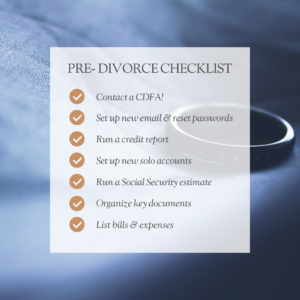

Pre-Divorce Checklist

Step 1:

Set up a new email account. Change ALL your passwords – social, online accounts, etc.

Step 2:

If you don’t regularly check your credit score, do it now. You’re planning for a life on your own, so your credit score is what lenders, landlords, and others will look at to determine whether you can buy or rent a home, buy a car, or even get a credit card. You’ll need to purchase it from MyFico.com. This will give you access to your entire credit history as well as tools to help you understand your score and steps you can take to improve it if necessary.

Step 3:

Open checking and savings accounts in your own name. If your credit is good, open a credit card account in your name. This gives you a start on your independent life.

Step 4:

Check your Social Security estimated benefits based on your employment history. Go to the SSA Retirement Benefits Estimator.

Step 5:

Create a “key document” file, either electronically or paper. Deeds, your minor childrens’ social security cards, investment accounts, 401(k), IRA and HSA statements, insurance policies, tax returns, etc. If you individually own assets such as real estate, jewelry, art or other collections that were either an inheritance or you owned before the marriage – document your ownership with pictures, provenance, wills, bills of sale, etc.

Step 6:

Make a list of all monthly bills and all debts, regardless of who pays them

Step 7:

Contact a financial advisor that has a Certified Divorce Financial Analyst professional designation. The CDFA can review your current assets, help you understand what your financial picture may look like after divorce, and can recommend a mediator or if necessary, attorneys that specialize in collaborative divorce or divorce litigation. Even more importantly, depending on what divorce process you choose, a CDFA financial advisor can be an invaluable resource as you move through the process.

Certified Divorce Financial Analyst

A CDFA has specialized training and experience and can be very helpful in valuing assets and debts; valuing the marital home; dividing retirement and pension accounts; determining the amount and duration of spousal support, setting up investment and savings accounts to provide for the education of children, and sorting through the tax implications. Equally important, the CDFA can help you set up a budget and work through the issues that arise as you begin your new life after divorce.

We end at step 7, contact a financial advisor, because very often your financial advisor can be extremely important in getting you through the next phase – choosing a divorce process. Whether you choose mediation, collaboration or litigation, your financial advisor can also be very helpful throughout the process.

The Bottom Line

There’s no understating how difficult the decision to divorce is. But thinking carefully through the options, and then taking steps to plan ahead can make a difference. Working with a financial advisor who knows your situation can help you make good decisions and follow through on the details.

This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

Reviewed by FINRA.

© 2020 CION Securities, LLC, Member FINRA / SIPC.