The most common perception of divorce is that of a long, expensive, adversarial legal process. But that doesn’t have to be the reality. There are options that can allow you to settle child custody, division of property and ongoing support without resorting to litigation. We’ll cover two divorce processes that can shorten the time and keep things less adversarial: Mediation and Collaboration.

The advantage, besides saving money and time, is that these options can help set healing in motion and create a framework for more cooperative co-parenting after a divorce.

Mediation

In a mediated divorce, you and your spouse select a neutral person who will help you negotiate and come to a resolution together. This typically requires a series of meetings that happen over the span of several months. The person does not have to be an attorney, although many attorneys specialize in this type of divorce.

The mediator has no power to decide anything about the case – their role is to outline the issues and help you both work towards an agreement. The mediator will work to create a customized, mutually acceptable agreement that prioritizes the needs of each party and your children by creating a parenting plan and sorting through schedules, child support, spousal support, division of marital property and debts. The mediator will draft the required paperwork, including the Memorandum of Understanding that memorializes your agreement.

The process is informal and very flexible, so it can allow you to structure meetings for times that are convenient for work and childcare schedules. In addition, if both parents are committed to putting minor children first and effectively co-parenting going forward, mediation can save both money and time. Outside professionals can be asked to join the process as necessary. The only real downside to mediation is that if you can’t work it out, you may end up escalating to a collaboration or even litigation, and the work done – and money spent – on the mediation is a sunk cost.

Collaboration: When You Need Legal Representation, But Don’t Want To Go To Court

A collaborative divorce is one in which both you and your spouse are represented by attorneys, but you commit to negotiating cooperatively in a series of meetings in which you are all present. You sign a contract called a “participation agreement”, which is also called a “no court” agreement because the goal is to complete the divorce without resorting to judicial intervention.

As in a mediation, outside professionals can be brought in as necessary, including financial experts, mental health specialists and child specialists. Collaboration is more expensive and time-consuming than mediation, and the downside is that if you cannot agree and escalate to litigation, your collaboration attorney will be disqualified from representing you and you will have to start over with a new attorney.

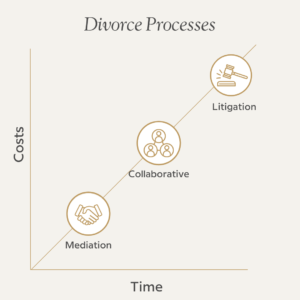

To compare the complexity, cost and time involved in each option, the graphic below places each of them on a scale of time and expense.

Data Source: The Cost of Divorce: 3 Processes. Mediation Matters. Note: Data is as of 2015 and drawn from a law practice in Boston, MA. Divorce costs vary based on location and situation.

There are a lot of factors that will determine which process is most appropriate, including the complexity of your situation and how possible it is for you and your soon-to-be ex-spouse to work together. If you have children, a mediator is often an excellent approach, as it saves a considerable amount of money and sets a precedent for the parents to resolve differences in an informal way without the need for adversarial court proceedings or court-appointed experts or evaluators. A collaborative divorce can also accomplish this, but because you both need to hire attorneys it can take longer and be more expensive.

Whichever approach you take, it makes sense to involve your financial advisor in the process. They already have a perspective on your assets and can provide necessary information – such as asset valuations or tax implications – that can keep the process moving forward. In some instances, you may want to have your financial advisor “quarterback” the process, as they often have sources of attorney referrals they have worked with effectively. In addition, many financial advisors have achieved a professional designation called a “Certified Divorce Financial Analyst” that provides them with additional experience and expertise in financial issues related to divorce.

Working with a CDFA

Including your financial advisor in your divorce process can streamline the process and keep things moving along. A Certified Divorce Financial Analyst has specialized training and experience and can be very helpful in valuing assets and debts; valuing the marital home; dividing retirement and pension accounts; determining the amount and duration of spousal support, setting up investment and savings accounts to provide for the education of children, and sorting through the tax implications. Equally important, the CDFA can help you set up a budget and work through the issues that arise as you begin your new life after divorce.

The Bottom Line

Divorcing through a non-adversarial process can help you work out effective solutions for your new reality. Working with your financial advisor and appropriate professionals outside of an adversarial legal proceeding can protect everyone’s interests and minimize the drain on your assets.

This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

Reviewed by FINRA.

© 2020 CION Securities, LLC, Member FINRA / SIPC.